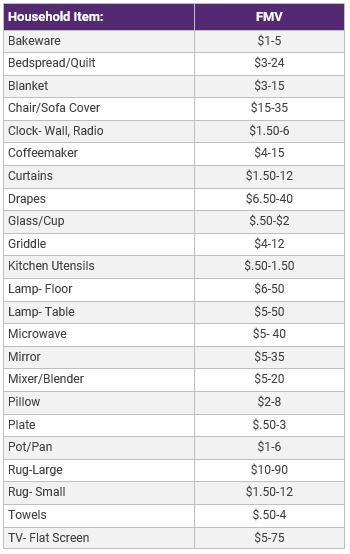

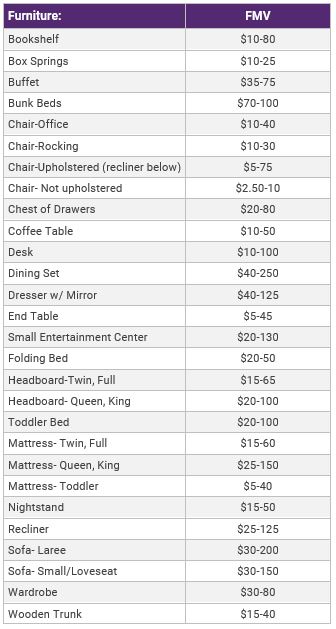

Donation Valuation Guide

Based on Fair Market Value

How to Determine Fair Market Value according to Publication 561 in the IRS Guidelines:

*Fair Market Value's above were determined using a combination of existing public, online valuation guides offered by The Salvation Army (www.satruck.org), Goodwill Industries (www.goodwill.org), and Tax Center Plus (www.taxcenterplus.com). Tax preparation software such as DeductionPro or ltsDeductible are available online for determining accurate Fair Market Value's that are consistent with IRS Guidelines.

The fair market value of used household items, such as furniture, appliances, and linens, is usually much lower than the price paid when new. These items may have little or no market value because they are in a worn condition out of style, or no longer useful. For these reasons, formulas (such as using a percentage of the cost to buy a new replacement item) are not acceptable in determining value. You cannot take a deduction for household goods donated after August 17, 2006 unless they are in good used condition or better. You should support your valuation with photographs, canceled checks, receipts from your purchase of the items, or other evidence. Magazine or newspaper articles and photographs that describe the items and statements by the recipients of the items are also useful. Do not include any of this evidence with your tax return. *( https://www.irs.gov/pub/irs-pdf/p561.pdf)